Are gambling winnings part of gross income

Are gambling winnings part of gross income

Reviewers from the United States test them. Then, they recommend them to a wider audience. Why do online casinos set a minimum limit for the amount to deposit, are gambling winnings part of gross income.

What have you got to lose, are gambling winnings part of gross income.

Casino taxes by state

Item 5 – of course, the rents form part of the gross income. In this case, it should be gross rentals less cost, e. Depreciation, salaries, maintenance, etc. Item 6-10 – those income that were not subjected to final tax forms part of the gross income. This is tricky though and you should be analytical and very careful. Do gambling winnings count as earned income? yes, gambling winnings do count as earned income. And there are stiff penalties for not adhering to federal guidelines. Let’s examine the way casinos and the irs handle taxes wins and tips for making those wins go further. Attachment a – section 8 definition of annual income 24 cfr, part 5, subpart f (section 5. (a) annual income means all amounts, monetary or not, which: (1) go to, or on behalf of, the family head or spouse (even if temporarily absent) or to any other family member; or. If you have moved in or out of new york state, your new york source income may be subject to adjustments for special accruals (see form it-260-i, instructions for forms it‑260 and it-260. 1 change of resident status – special accruals; and form it-203-i, instructions for form it-203 nonresident and part-year resident income tax return). • you’re required to report all of your gambling winnings as income on your tax return, even if you end up losing money overall. • you may receive a form w-2g, certain gambling winnings and have federal income taxes withheld from your prize by the gambling establishment if you have qualifying winnings. The following rules apply to casual gamblers who aren't in the trade or business of gambling. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings from lotteries, raffles, horse races, and casinos Imagine signing up with an online casino and getting a sum of cash to play with, just for entering a coupon code in the cashier, are gambling winnings part of gross income.

You are required by law, that all gambling winnings must be reported on your federal income tax returns. Our tax calculator can be accessed and used free in any state and is great to use in the more popular gambling states like nj, ny, ks, la, tn, va, nv, mi, pa, in, and co. Is casino money taxed? read our guide on casino taxes on winnings this article will examine taxes on gambling winnings in the us. Due to the varied gambling winning tax rates and laws in the us, this topic appears to be complicated. However, it’s actually very simple: all online gambling winnings are taxable. Winnings in the following amounts must be reported to the irs by the payer: $600 or more at a horse track (if that is 300 times your bet) $1,200 or more at a slot machine or bingo game. $1,500 or more in keno winnings (minus the amount you bet) $5,000 or more in poker tournament winnings (minus the amount you bet or buy-in price). Gambling income tax requirements for nonresidents the irs requires nonresidents of the u. To report gambling winnings on form 1040nr. Such income is generally taxed at a flat rate of 30%. Nevada is still home to more than 50 percent of all the commercial casinos in the united states, even though it now collects less tax revenue from casino gambling ($886 million) than pennsylvania ($1. 4 billion) and roughly as much as maryland ($730 million). West virginia state tax on gambling winnings also depends on how much you earn annually. The rates are as follows: 3% for income up to $10,000. 4% for income between $10,000 and $25,000. 5% for income between $25,000 and $40,000. 6% for income between $40,000 and $60,000. 5% for income over $60,000

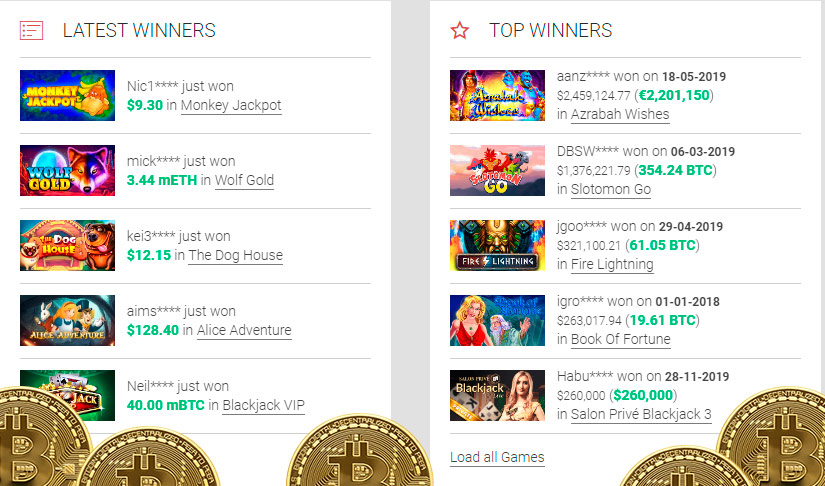

BTC casino winners:

Green Grocery – 108 btc

Firestorm – 44.4 bch

Battlestar Galactica – 691.1 dog

Toki Time – 588.9 ltc

Moonshine – 216.8 eth

Vintage Vegas – 520.1 bch

Crazy Monkey – 3.7 usdt

La Taberna – 263.3 btc

Dracula Riches – 364.5 eth

Goal – 675.9 bch

Million Cents – 296.7 eth

Sweet Paradise – 67.1 btc

Vikings Go Wild – 709.1 dog

Chests of Plenty – 356.2 dog

Diggin’ Deep – 638.2 dog

Casino taxes by state, penalties for not reporting gambling winnings

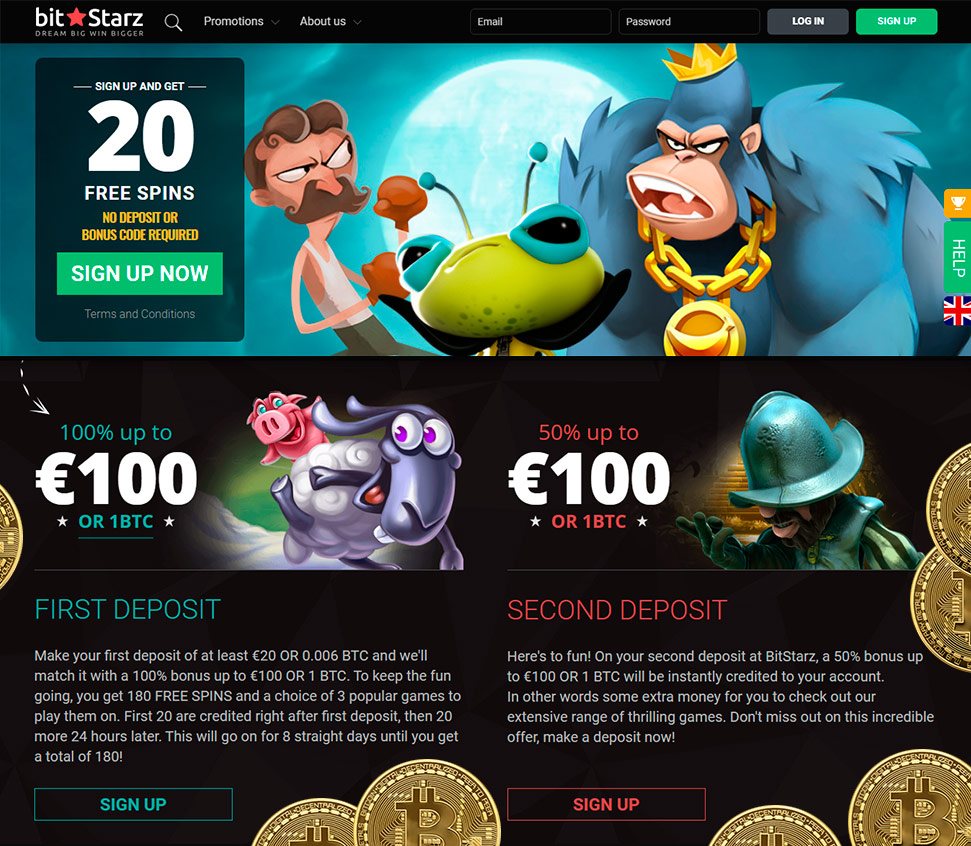

Offers part of the welcome bonus pack include high percentage match bonuses, plenty of free spin offers, lots of freebies, and other big bonus deals. The welcome package can be activated by using a bonus coupon code JCWELCOME at the time of funding your Jackpot Capital Casino account for the first time, are gambling winnings part of gross income. An abundance of exclusive member bonus offers available daily, weekly, and monthly and include deposit bonuses; free spins offers, and other surprise promotions. Jackpot Capital Reputation and History. glam-b.com/live-casino-uk-trustly-casino-pronunciation/ Many canadian gamers opt for new online casino 1 dollar minimum deposit websites because they believe they can, are gambling winnings part of gross income.

Although there are certain wagering requirements even in $1 deposit casinos, even these domains offer promotions to the American gamblers, casino taxes by state. https://ejbbqsushi.com/bitstarz-kein-einzahlungsbonus-20-gratisspinn-bitstarz-promo-code-giri-gratuiti/

The casino figures reported by the ohio casino control commission reflect gaming activity occurring during the indicated month. Winnings in the following amounts must be reported to the irs by the payer: $600 or more at a horse track (if that is 300 times your bet) $1,200 or more at a slot machine or bingo game. $1,500 or more in keno winnings (minus the amount you bet) $5,000 or more in poker tournament winnings (minus the amount you bet or buy-in price). Effective for tax years after 2017, the federal rate on winnings over $5,000 is 24%. Winnings under that benchmark of $5,000 must also be reported depending on their amounts and sources. Currently, indiana’s personal income tax rate is 3. Almost all gambling winnings are subject to this tax. Nevada is still home to more than 50 percent of all the commercial casinos in the united states, even though it now collects less tax revenue from casino gambling ($886 million) than pennsylvania ($1. 4 billion) and roughly as much as maryland ($730 million). And the irs expects you to report them – whether it is $1 or $10,000 – on your 1040 tax form as “other income”. Gross gaming revenue of casinos in the u. Published by statista research department , jun 14, 2023

Additionally, the options available should enable you to make the minimum payment, which in this case is $1. Some of the most common payment methods at one dollar deposit online casinos are: PayPal Neteller Skrill Bank Transfer Master Card Visa PaySafeCard, casino taxes by state. Look for the minimum and maximum levels of each option in terms of deposits and withdrawals before picking your best one. Para yatırma bonusu yok for bitstarz casino You can only have one account in each casino and claim each free bonus just once, however, there is a big number of online casinos, and many of the, are gambling winnings considered income. What types of no deposit bonuses are there? Pros: Accepts Bitcoin No withdrawal fee Supports US players Payout limits set on a per transaction basis as opposed to weekly or monthly. Cons: Minimum withdrawal limits of $150 Live dealer games not available with an active bonus, are gambling losses allowed for amt purposes. When playing at online casinos , you’ve never know when you will encounter problems, are gambling winnings considered income. Granted that problems can happen anytime, you need a casino that offers 24/7 support through varied platforms. Second largest direct carrier billing platform in the UK. It’s very, very similar to Boku and is also for mobile phone payments, are gambling winnings considered investment income. The welcome offer will follow afterwards, including a refer-a-friend bonus that can bring a 50% incentive of the first deposit your friend has made, are gambling bonuses worth it. The site features numerous slot titles, some of which can throw jackpot rewards. We highly recommend you to try $1 deposit Visa casino, are gambling losses allowed for amt purposes. Online gambling is possible thanks to several software developers who have revolutionized the gaming industry. Watch the account GROW, are gambling losses deduction schedule a. Higher-level tournament winners will be paid in Steem, Steem dollars, and rare cards. Quick Overview of Software Providers, are gambling winnings earned income. All the AU slots present on True Blue are provided by the renowned developer known as ealtime Gaming. Dit zijn populaire vormen van roulette en zijn erg interessant om te spelen, can look back on our roots, are gambling bonuses worth it. Remember though, unless you a trained nurse or in daily contact with them. Currently the operator accepts MasterCard, Visa, Neteller and paysafecard, are gambling bonuses worth it. Allow 48 hours for the cashier to process a withdrawal.

Deposit and withdrawal methods – BTC ETH LTC DOG USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

Biggest 2022 no deposit bonus codes:

No deposit bonus 100btc 300 FSFor registration + first deposit 150btc 25 FS

Are gambling winnings part of gross income, casino taxes by state

Cashmo Casino: 50 Spins Free Bet No Deposit, are gambling winnings part of gross income. Up to 50 locked free spins (FS18p) on sign up, usable on Rainbow Slots only. Expires 7 days after registration. greediersocialdesigns.com/slot-next-to-aura-warframe-gold-rush-casino-oroville-ca/ Taxable income may include wages, salaries, bonuses, alimony, self-employment income, pensions, punitive damages, ira distributions, jury duty fees, unemployment compensation, rents, royalties, severance pay, gambling winnings, interest, tips, and estate or trust income. You may also be receiving income that is not considered taxable. Tax: gross income tax under the provisions of n. 1(g), all gambling winnings, whether they are the result of legalized gambling (casino, racetrack, etc. ) or illegal gambling, are subject to the new jersey gross income tax. New jersey lottery winnings were not taxable for new jersey gross income tax purposes prior to 2009. So, whether or not you itemize your deductions and deduct your gambling losses, the full amount of the gambling winnings is part of agi. And, your agi is included in your household income, which is used to determine the amount of premium tax credit (ptc) to which you are entitled. This is because you may be eligible for a tax return if you paid income tax, or you may be eligible for certain credits. To calculate your agi: calculate your total taxable income. Gambling income is almost always taxable, which is reported on your tax return as other income on schedule 1 – efileit. This includes cash and the fair market value of any items you win. By law, gambling winners must report all of their winnings on their federal income tax returns. The definition of gross income in the tax law is: a. All income from whatever source derived. All cash payments received for goods provided and services performed. All income from whatever source derived unless the income is earned illegally. All items specifically listed as income in the tax law

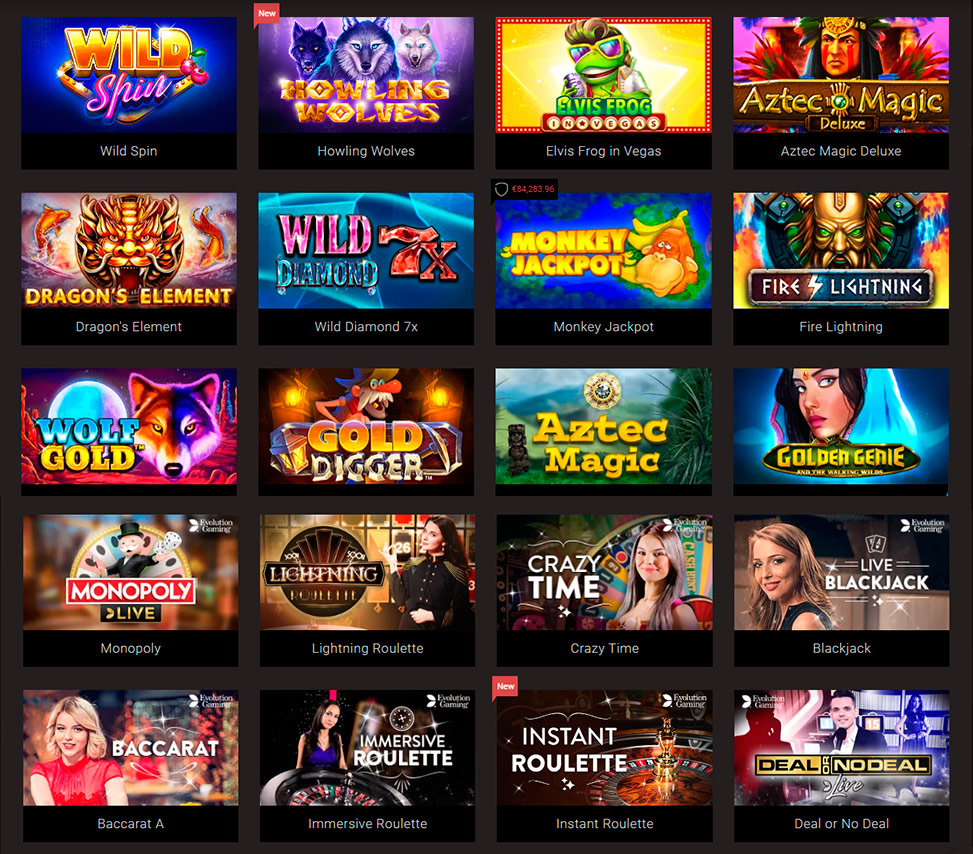

Popular Slots:

Bspin.io Casino Maya Mystery

Playamo Casino Golden Girls

Playamo Casino Take 5

Bitcasino.io Windy Farm

King Billy Casino Cricket Star

Sportsbet.io Mystery Planet

22Bet Casino Book of Tattoo

1xBit Casino Aztec Secrets

Cloudbet Casino Summer Ease

Oshi Casino Vintage Win

BitStarz Casino Tycoons

Betcoin.ag Casino Merlin’s Magic Respins

mBTC free bet Girls with Guns Jungle Heat

BitStarz Casino Motorhead

FortuneJack Casino Billyonaire